AfricaFocus Notes on Substack offers short comments and links to news, analysis, and progressive advocacy on African and global issues, building on the legacy of over 25 years of publication as an email and web publication archived at http://www.africafocus.org. It is edited by William Minter. Posts are sent out by email once or twice a month. If you are not already a subscriber, you can subscribe for free by clicking on the button below. More frequent short notes are available at https://africafocus.substack.com/notes, and are also available in an RSS feed.

Editor´s Note

According to estimates released in July by Forbes magazine, there are now 2,781 billionaires around the world, 813 of them in the United States. China (including Hong Kong) has 473 and India 200. The United States has only about 1/4 of the total population of either China or India. But among billionaires, the United States outnumbers the two other countries put together.

On July 29, AfricaFocus featured Gabriel Zucman´s plan for a 2% global tax on billionaires. In today´s AfricaFocus, I turn to the United States in particular, featuring excerpts from The Billionaire Century, a report from Americans for Tax Fairness. According to that report:

America’s roughly 800 billionaires are collectively worth a record $6 trillion as of July 11, the most money ever amassed by the nation’s ultra wealthy, and nine times more than the billionaire class held at the beginning of the 21st century, according to a new analysis of Forbes data by Americans for Tax Fairness (ATF). Billionaire wealth has more than doubled, up by more than $3.1 trillion, since the passage of the 2017 Trump-GOP tax law, which was heavily slanted towards the rich.

I also include below, for easy comparison, the short summary of Zucman´s report, as well as the transcript of a National Public Radio story on the man behind the report.

THE BILLIONAIRE CENTURY

July 11, 2024

After 24 Years of a Tax Code Rigged in Their Favor, U.S. Billionaires Are Now Worth a Record $6 Trillion

https://americansfortaxfairness.org/the-billionaire-century/#

America’s roughly 800 billionaires are collectively worth a record $6 trillion as of July 11, the most money ever amassed by the nation’s ultra wealthy, and nine times more than the billionaire class held at the beginning of the 21st century, according to a new analysis of Forbes data by Americans for Tax Fairness (ATF). Billionaire wealth has more than doubled, up by more than $3.1 trillion, since the passage of the 2017 Trump-GOP tax law, which was heavily slanted towards the rich.

“The failure to adequately tax the astronomical growth in billionaire wealth over the last quarter century has helped create this unprecedented concentration of financial power,” said David Kass, ATF’s executive director. “Reaching this dubious milestone is yet one more reason not to renew the expiring Trump-GOP tax cuts for the rich that are set to sunset next year, and instead use their expiration as an opportunity to pass real tax reforms that ensure billionaires and other super-wealthy people finally pay their fair share.”

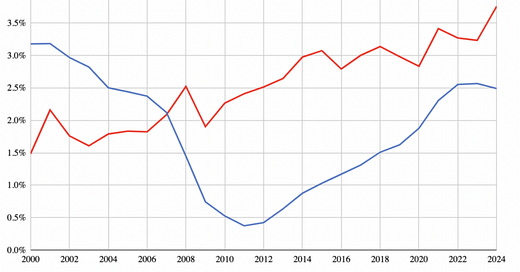

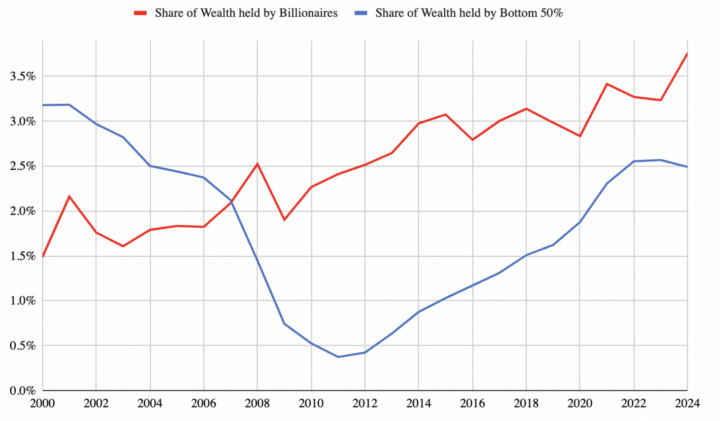

The ninefold jump in billionaire wealth this century left the rest of Americans behind, the ATF analysis found. The collective net worth of the bottom half of American society–accounting for more than 66 million households–has grown nearly five times slower than the wealth of billionaires this century. Moreover, COVID-related transfer payments likely account for a large part of that wealth growth among the bottom 50%, since it’s almost all happened since 2020.

Because of this extreme disparity in wealth growth, the nation’s handful of billionaire households this century became richer than the collective wealth of tens of millions of families in the bottom 50%. The billionaires rocketed past the bottom 50% in wealth during the Great Recession that destroyed so much middle- and working-class wealth. The nation’s 800 billionaires alone now hold roughly 3.8% of the entire nation’s wealth, while the roughly 66 million American families in the bottom half control just 2.5%.

Many of the components of the Trump-GOP tax law set to expire at the end of 2025 benefit the wealthy, including billionaires. A lower top tax rate, the weakened Alternative Minimum Tax (AMT), an enfeebled estate tax and other handouts to the rich in that law have undoubtedly contributed to the buildup of billionaire wealth in recent years. Republicans have generally said they want to extend all the expiring parts of the law, at a cost of some $5 trillion.

Other parts of the tax code that predate the Trump law play an even bigger role in the growth of billionaire dynasties. They include the nearly half-off tax discount on prominent forms of investment income; the shielding of lifetimes of capital gains from any tax at all (the “stepped-up basis” loophole); and the failure to tax gains in assets that go unsold (“unrealized” gains), despite the very real economic benefits offered by those gains to their wealthy owners.

President Biden and leading congressional Democrats have proposed multiple solutions to the dilemma of undertaxed billionaires. They include ending the investment-income tax discount and closing the stepped-up basis loophole on the highest incomes; annual taxation of the unrealized gains of the nation’s wealthiest households; and taxing the value of the biggest fortunes.

ATF’s report is the latest in a four-year series by the group revealing the troubling growth in billionaire wealth and the use of that billionaire wealth to distort our democracy.

A blueprint for a coordinated minimum effective taxation standard for ultra-high-net-worth individuals

by Gabriel Zucman, June 25th, 2024

https://gabriel-zucman.eu/files/report-g20.pdf

Summary of 40-page report:

This report presents a proposal for an internationally coordinated standard ensuring an effective taxation of ultra-high-net-worth individuals. In the baseline proposal, individuals with more than $1 billion in wealth would be required to pay a minimum amount of tax annually, equal to 2% of their wealth. This standard could be flexibly implemented by participating countries through a variety of domestic instruments, including a presumptive income tax, an income tax on a broad notion of income, or a wealth tax. The report presents evidence that contemporary tax systems fail to tax ultra-high-net-worth individuals effectively, clarifies the case for international coordination to address this issue, analyzes implementation challenges, and provides revenue estimations.

The main conclusions are that:

(i) building on recent progress in international tax cooperation, such a common standard has become technically feasible;

(ii) it could be enforced successfully even if all countries did not adopt it by strengthening current exit taxes and implementing “tax collector of last resort” mechanisms as in the coordinated minimum tax on multinational companies;

(iii) a minimum tax on billionaires equal to 2% of their wealth would raise $200-$250 billion per year globally from about 3,000 taxpayers; extending the tax to centimillionaires would add $100-$140 billion;

(iv) this international standard would effectively address regressive features of contemporary tax systems at the top of the wealth distribution;

(v) it would not substitute for, but support domestic progressive tax policies, by improving transparency about top-end wealth, reducing incentives to engage in tax avoidance, and preventing a race to the bottom;

(vi) its economic impact must be assessed in light of the observed pre-tax rate of return to wealth for ultra-high-net-worth individuals which has been 7.5% on average per year (net of inflation) over the last four decades, and of the current effective tax rate of billionaires, equivalent to 0.3% of their wealth.

Meet the man with the plan to tax the world's wealthiest 3,000 people

By Patrick Wood, Kathryn Fink, Scott Detrow

National Public Radio, August 6, 2024

https://www.npr.org/2024/08/06/nx-s1-5064662/global-wealth-tax-g20-poverty-climate-change

Economists say creating a 2% tax minimum for the extremely wealthy would unlock an extra $250 billion per year. Over the last decade, calls to tax the rich have grown louder around the world — but the needle hasn’t exactly moved. Billionaires are still amassing huge amounts of money each year and they’re paying less in taxes than they have in decades.

Now, the Brazilian government has a new proposal: a 2% global wealth tax on the uber-rich. It would impact the 3,000 wealthiest people in the world. And while 2% might not sound like much, consider how little billionaires are paying in taxes right now: something like 0.3% of their wealth, according to a new report commissioned by the G20. Economists say creating a 2% tax minimum would unlock an extra $250 billion per year, which could go toward addressing a number of issues, like climate change or global poverty.

But there’s a question of feasibility. How do you coordinate a global tax — especially when key countries like the United States are saying they’re not on board?

The man behind the plan

The idea of a global wealth tax was put forward by Brazil earlier this year and discussed during a recent G20 meeting, ahead of the summit in November. The person behind the plan is Gabriel Zucman — an economist at the Paris School of Economics and the University of California at Berkeley. He told All Things Considered the starting point was the “overwhelming evidence” that the super rich have very low effective tax rates today and pay much less tax than middle class people in the U.S. and throughout the world.

This, he said, is a problem for two reasons:

The money: "There is a big loss of tax revenue for governments. That's money that we could spend on education, on health, on infrastructure and that we can't because they don't pay tax.”

Fairness: "It's difficult to understand why the very individuals with the highest ability to pay taxes should be allowed to pay less than ordinary people."

The idea generated a lot of interest at the recent G20 meeting. France, Spain, South Africa and several other nations have voiced support. But it was also met with skepticism. U.S. Treasury Secretary Janet Yellen, for example, said she wasn’t on board with the idea. Germany also expressed opposition. But Zucman believes it could still become a reality.

A (possible) path forward

First, Zucman says no one expects a global wealth tax to happen soon — he’s talking about years down the road — and it’s not without complications. “There is a risk of a race to the bottom. Of some countries just choosing not to tax billionaires to try to attract them,” he says. But Zucman also believes there doesn't need to be a global consensus for it to work. Instead, there just needs to be a critical mass of countries that would do two things:

Agree to tax their own billionaires.

Then also tax the billionaires of other countries if they are undertaxed at home and also derive some of their wealth abroad.

That could be a tall order, given changing leadership and the run of elections in key G20 countries, including the United States later this year.

Still, Zucman remains hopeful.

“Leadership might change, but what does not change is the overwhelming popular demand everywhere for this type of policy, for fixing this big tax injustice of our time,” he said. “That's what fundamentally makes me optimistic that at some point, and I hope it will be sooner rather than later, we will reach a common agreement.”