Cautious Optimism on Climate Change

Exponential Technical Advances May Outpace Political Resistance

In 2023, electrical heat pumps outsold gas furnaces in the United States for the second year in a row. The state of Maine led the way, meeting its initial goal of installing 100,000 heat pumps two years ahead of schedule. Maine's success, fueled by state subsidies, consumer demand, and heating contractor initiatives, has been a win-win for the climate and for household finances.

This example is only one example of what Bloomberg New Energy Finance senior contributor Michael Liebreich recently cited as the "Five Superheroes" of the transition to a net zero energy economy.

This issue of AfricaFocus Notes contains excerpts from Liebreich's blog post on February 22. In an earlier post last September Liebreich had laid out five obstacles to progress, including "political and social inertia; and regulatory capture and predatory delay." Other analysts I respect, such as Tomas Pueyo of Uncharted Territories, have also laid out technically feasible scenarios for slowing global warming, such as injection of sulphuric oxide high into the atmosphere with giant balloons.

Yet, as readers of AfricaFocus Notes are well aware, many obvious steps to provide renewable energy and curb the need for fossil fuels are falling short for lack of political will and financing from the rich countries which have been most responsible for global warming.

Speaking at a conference this month in Zimbabwe, Claver Gatete, United Nations under-secretary-general and executive secretary of the Economic Commission for Africa (ECA), noted that "In 2020, Africa’s total greenhouse emission was about 3 percent of global emissions. But we are the region with the most burden of impact."

He added that the G20 estimates Africa needs an additional $1.8 trillion for climate action and $1.2 trillion for development financing by 2030, but that funds designated for Africa will fall well short of that.

Net Zero Will Be Easier Than You Think

February 22, 2024

By Michael Liebreich, Senior Contributor, BlooombergNEF

Welcome to the second part of my two-part article exploring the bull and bear cases for the net-zero transition.

In September last year, I laid out the bear case, highlighting the Five Horsemen of the Transition that will make achieving net zero difficult, perhaps impossible. By way of reminder, these were: poor economics of clean solutions beyond wind, solar and batteries; inadequacy of our current electrical grid; soaring demand for critical minerals; political and social inertia; and regulatory capture and predatory delay. Five formidable challenges.

...

Now it is time to present the bull case – the five forces even more powerful than the Five Horsemen which give cause for optimism. Not powerful enough, in all likelihood, to get us to net zero in 2050 and hold the temperature increase to 1.5C, but powerful enough to get us to net zero by 2070 and keep to a Paris-compliant “well below 2C”.

Say hello to the Five Superheroes of the Transition.

Superhero 1: Exponential Growth

Twenty years ago, in 2004, it took an entire year to install a single gigawatt of solar PV. By 2010, it took the world one month to install a gigawatt. By 2016, one week. Last year saw single days on which a gigawatt of solar PV was installed.

Cumulative solar PV installations have doubled ten times in that period, and it is doublings that drive down costs. Solar PV has been delivering a learning rate of around 25% per doubling for the past five decades, chopping the cost of modules from $106 per Watt of capacity in 1975 to $0.13/W in November 2023 (according to BloombergNEF’s solar price index), a factor of 820.

The wind sector has doubled six times over the past 20 years – relatively staid, but only by comparison with solar PV. In 2004, 8 gigawatts of wind power were installed; in 2023 the figure was around 110GW, including 12GW of offshore wind. Wind’s costs too have plummeted, from $0.12/kWh for the best projects twenty years ago to around $0.02/kWh for onshore wind and $0.05/kWh for offshore.

As a result, wind and solar together make up the fastest-growing source of electricity in history. Twenty years ago, they accounted for less than one percent of global power; 10 years ago, the figure edged up to 3%. By the end of last year, it had surged to 15%. ...

In 2004, the largest operating wind turbine had a capacity of 2.5 megawatts. Ten years ago it was 8MW. Today it is 15MW. The next generation wind platform, being developed in China, will deliver more than 20MW per turbine. In solar, manufacturing capacity, which was around 1.5GW in 2004 and 48GW at the end of 2014, is expected to pass the TW mark by 2025. At the COP28 meeting in Dubai, the world agreed to triple installed renewables by 2030; in its latest Renewables Report, the IEA forecasts that achieving two-and-a-half times would not even require new policies.

The same thing has been happening for batteries – they have in fact been racing through doublings even faster than solar: five of them in the last eight years. In 2015, some 36GWh of lithium-ion batteries were produced; last year the total was around 1TWh. Over the past decade, cell costs have come down from $1,000 to $72 per kWh, and at the same time energy density has doubled and degradation per cycle has halved. We are also seeing new battery chemistries such as iron-air and sodium-ion that promise to be even cheaper than lithium-ion.

...

I’m the last person to claim we are headed to a world of 100% wind, water and solar. Nuclear and geothermal power, bio-based solutions, CCS and carbon removal will all play a role. I’m just saying that the growth of wind and solar is likely to look exponential for a long time to come.

Superhero 2: Systems Solutions

Many people find it hard to accept the idea of a power system with cheap, abundant wind, solar and batteries at its heart, citing the inability of batteries to cover periods over a day or so when wind and solar output fall away dramatically.

The answer to variability, however, is not batteries. It is a system solution – a combination of demand response, interconnections, excess generating capacity, pumped storage, nuclear power, CCS, hydrogen and biogas long duration storage, integrated by means of an extensive grid and managed using the latest digital technologies. The good news is that each of these constituent technologies is seeing remarkable growth and investment, and they are slowly being knitted together by successive iterations of regulation, making system solutions the Second Superhero of the Transition.

...

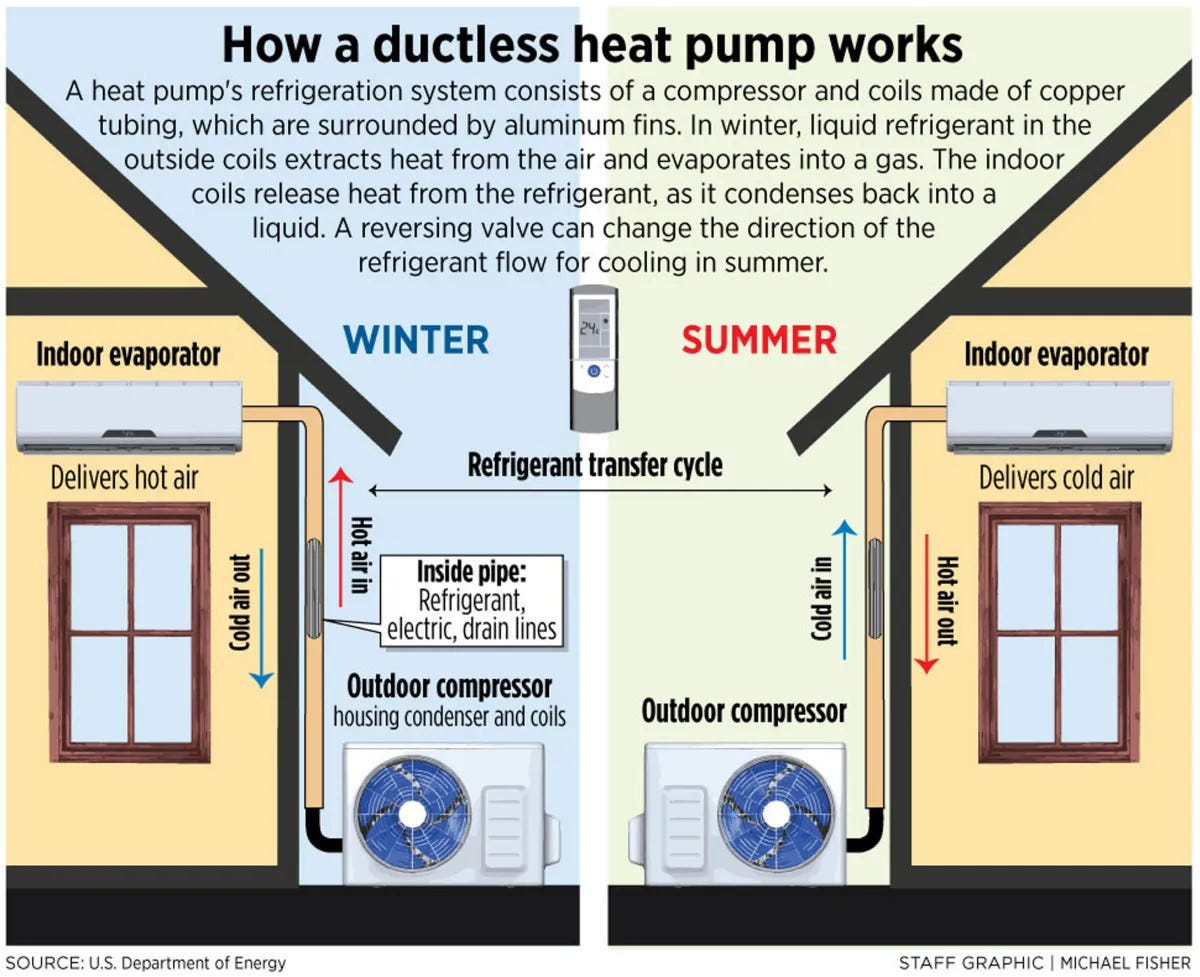

EVs and heat pumps are the natural complementary technologies to wind and solar, in that their use can be time-shifted by a few hours or days to accommodate mismatches in supply and demand. Faced with a grid that it is curtailed, instead of building costly and unpopular transmission lines, or running a hydrogen electrolyzer for a few hours a week and blending the exorbitantly expensive results into the gas grid for little value, let the power price drop locally and watch people rush out to buy EVs and heat pumps.

We have learned time and again over the past 20 years, price signals matter. Get them right, and things move much faster than you might expect.

Superhero 3: Great power competition

...

Overall, there are no longer any so-called hard-to-abate sectors. There are only some sectors in which clean solutions are not projected to undercut their fossil-based alternatives, perhaps ever. They will require a carbon price, but it’s an affordable carbon price: one that we are wealthy enough to pay, should we so decide. For even the most challenging sectors, we are now seeing more than one competing pathway viable at carbon prices in the range of $75 to $250 per ton of CO2 equivalent, which is a far cry from 2018, when it looked like they might need carbon prices of $500 or even $1,000/tCO2.

Combine this line-of-sight to decarbonization with a new era of international rivalry between the US, China, Europe and emerging industrial powerhouses such as India, Brazil, Mexico and Turkey, and the conditions are set for a race to own the net-zero industries of the future – making great power competition and the self-fuelling momentum of the no-longer-hard-to-abate sectors the Third Superhero.

Superhero 4: Disappearing Demand

The fourth Superhero of the Transition is the fact that achieving net zero will require a lot less in the way of minerals than we think, and they will be cheaper than we fear.

The fivefold increase in demand for critical minerals from the energy sector was, you may recall, my third Horseman of the Apocalypse. However, estimates of critical mineral demand from clean energy technologies have been very substantially over-estimated. Even well-constructed mainstream forecasts are missing the impacts on demand of technological improvements, material substitution and, critically, recycling.

...

In addition to the collection rate, what is important is the recovery rate, the proportion of materials recovered for use, and in particular the proportion of critical minerals. And here the news is very good, with reports by incumbent materials companies and challenger startups like Redwood Materials of recovery rates of as much as 95%. This is very significant. Suppose your battery has a life span of 15 years, and together collection and recovery rates exceed 90%. Then as long as battery energy density improves by 10% every 15 years – and remember it doubled in the past decade – your initial battery minerals will continue providing the same storage services forever. This is what circularity looks like, and it is not taken into account in any of the big energy and mineral demand models – in fact most current EV lifetime carbon assessments do not include recycling at all.

At the same time, the transition will naturally cause demand for resources from the fossil fuel industry to fall away, as explained by independent energy analyst Michael Barnard. The 15% of global energy use in oil and gas extraction and refinement? Gone. Some 40% of blue-water shipping that currently moves oil, gas and coal around the world? Sold for salvage. And 15% of shipping used to move iron ore? Largely made redundant by local green steel manufacture. Hydrogen demand from hydrocracking to make petrol and diesel? Gone. Oil and gas pipelines? Recycled. Even cement and steel demand must eventually start to shrink: we have passed peak child and peak urban migration; we will at some point pass peak population.

Finally, the old adage “the cure for high prices is high prices” will apply to transition minerals every bit as much as it does to other commodities, as we are already seeing in the prices of critical minerals, down by 80% from their highs two years ago despite soaring demand.

Superhero 5: The Primary Energy fallacy

The fifth and final Superhero is an absolute zinger: The entire decarbonization challenge is far smaller than is made out by its critics. The reason lies in the nature of Primary Energy Demand, the metric that dominates public debate about the transition.

The history of Primary Energy dates back to the 1970s, when western countries feared they would be starved of the raw energy needed by their economies, and began to cast around the world for energy resources to make sure they controlled a big enough proportion. The agency created to do this was the International Energy Agency, and their key metric was Primary Energy Demand. You’ll still find it called that in IEA energy reports today.

Despite its name, however, Primary Energy Demand is not really a measure of demand. Let’s use an example. Say you light your hallway with a 75-Watt incandescent lightbulb, illuminated 2,000 hours and consuming 150 kWh per year. Power it with electricity from a coal plant with 35% efficiency, add 10% grid loss, and you create Primary Energy Demand of 476 kWh.

You could, however, deliver the same amount of light with a single 10W LED bulb. Allow the same 10% grid loss, and it uses just 22kWh. Run that LED on wind, solar or hydro power and you have reduced your Primary Energy Demand by 95% and eliminated its CO2 emissions – with no reduction in lighting use.

Take a second example, switching from an internal combustion car to an electric car. Say your VW Golf is managing 40 miles per gallon, a pretty normal figure for real-life usage. This translates to 1kWh/mile or, after accounting for losses in extracting, refining and distributing your fuel, 1.2kWh/mile. The equivalent electric VW ID3, after adjusting for grid and charging losses, uses just 0.3 kWh/mile. By switching, you have achieved a 75% reduction in Primary Energy Demand and opened up a route to eliminate 100% of emissions from driving – with no reduction in mobility.

A third example. Heating the average US home requires 57 million British thermal units per year. If you are heating with gas or oil, after adjusting for 15% upstream losses and 90% furnace efficiency, that comes to 21 MWh per year. Switch to a heat pump with a year-round coefficient of performance of 4, allow 10% for grid losses, and your energy use is reduced to 4.6MWh. Powering a heat pump with clean electricity can reduce your Primary Energy Demand by 78% and eliminate CO2 emissions (and methane leaks) from space heating – with no reduction in comfort.

See the pattern? The transition is not about replacing all of Primary Energy Demand with something cleaner, it just needs to deliver energy services, a vastly smaller quantum, in a clean way.

...

The Japanese have a word – Mottainai – for the reverence that should be paid to efficiency and the sadness caused by waste. This should be our guide as we build the energy system of the future – a system that extracts every last unit of energy (and exergy, which we met in my piece last year on the electrification of heat) from the resources we use.

We should be identifying the energy services needed to power the global economy and figuring out how to deliver them in the cheapest, cleanest and most reliable way. Whether Primary Energy Demand increases or decreases, irrespective of how it is defined, is simply not a matter of any importance.

And finally

So, there you have it, the five Superheroes of the Transition – the five megatrends that will help get the world to net zero: Exponential growth, system solutions, great power competition, disappearing demand and the primary energy fallacy. While the Five Horsemen are knotty problems of the here-and-now, the Five Superheroes are powerful longer-term trends, which gives them the advantage.

There is in fact a sixth Superhero, or rather a superpower that lies within all of us. I believe society has reached a tipping point beyond which it is unthinkable not to deal with climate change, pollution and environmental degradation.

In the same way that there came a point when discharging untreated sewage into the street, or smoking in public buildings, became unacceptable, it is becoming unacceptable to burn fossil fuels. The generation that regarded it as normal – irreplaceable, even a kind of birth-right – is losing its place at the head of the table and being replaced by a generation that is in no doubt about the need to “stop burning stuff”.

That may not make the technical challenges any easier, but it creates a virtuous circle between the inevitability of the transition, the attraction of talent, the tipping of the balance of risk in favor of net-zero solutions, and progress towards net zero.

That leaves only one question – particularly in the light of this past year’s deeply troubling temperature anomalies – will we get there in time?

Bill, thank you for sharing the article. The trends leading to optimism are very interesting! I really liked explanation of the 6th Superhero and of course the last cautionary sentence is unavoidable.